The Complete Guide to B2B SaaS Growth

Building Repeatable, Scalable, and Profitable Success

If you've been following Business Revealed since the first episode, you've surely realized that the startup world, and entrepreneurship in general, is full of trial and error. You design something new and move to the testing phase, things rarely go perfectly, and mistakes are common. So you start over, again and again, until your hypothesized idea is ready for market validation by the general public - the only true final judge that can determine a product's success or failure.

This new episode also talks about mistakes, but it also discusses successes — the kind that can transform a small local company into an internationally renowned scalable business. Dreaming costs nothing, which is why it's better to do it very seriously.

The mistake I'm starting with today to introduce this new episode of my newsletter is one of the most common during a startup's go-to-market phase: considering the achievement of product-market fit as the right moment to aim for exponential growth.

While this rule might work for many B2C companies, the same cannot be said for B2B. In this case, before starting to spend money on marketing and sales operations, it's important to focus on a step that's often ignored: the search for a repeatable, scalable, and profitable growth model.

How to Increase Company Value

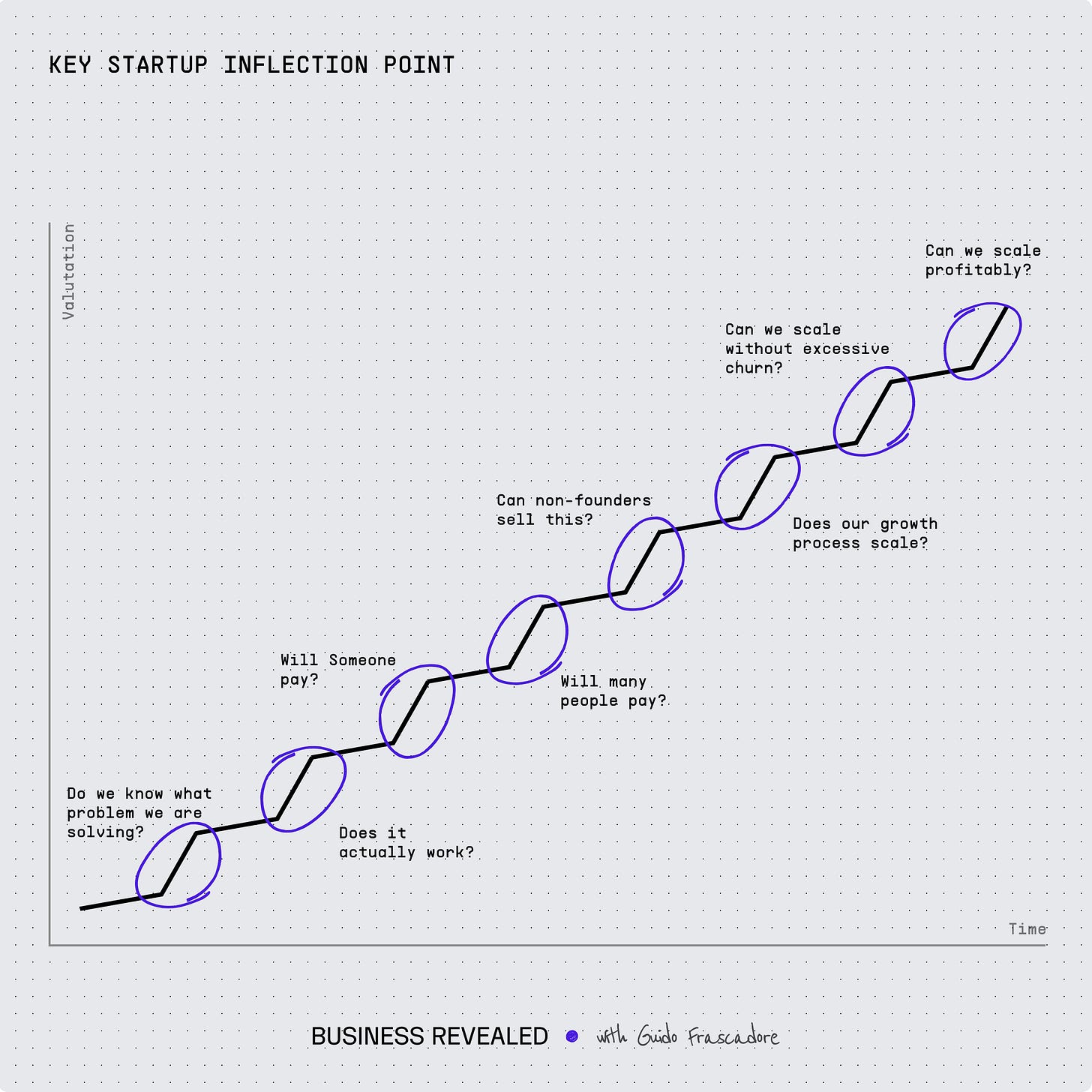

The strategic plan that should guide any startup toward building a repeatable, scalable, and profitable money machine goes hand in hand with the company's growth and economic valuation.

Along the journey, there will be many milestones to reach, but each one will have the main objective of reducing the risk level of key elements that characterize a company's activities.

The more a company can reduce its business risk levels, the more value it will gain, demonstrating reliability in the market and attracting capital from investors. But that's not all - focusing on risk reduction will help the company maintain a well-defined roadmap and prioritize objectives to achieve.

Is Your Product-Market Fit the Right One?

The very first element to examine for mitigating associated risks is the product-market fit hypothesis.

Who is the product/service for?

Will there really be people willing to pay to buy it?

Does the product work?

What benefits will customers derive from using it?

If you cannot measure it, you cannot improve it"

said physicist William Kelvin, and in this case too, the answer to these questions is obtained by measuring variables that help understand whether the identified product-market fit can lead to business scalability

The Role of Bookings

In the world of startups offering SaaS solutions, Annual Recurring Revenue (ARR) is one of the main indicators for measuring a company's long-term stability and growth. However, each metric plays a different role depending on a company's phase, and in the case of product-market fit, ARR isn't enough.

The most reliable indicator of whether the identified product-market fit represents a scalable hypothesis is "bookings." Bookings refer to the total number of contracts (recurring and non-recurring) or orders signed with customers in a given period. Keep in mind that contracts might include future commitments—revenue that hasn't been accounted for yet and, therefore, isn't included in ARR calculations.

When the number of bookings begins to grow consistently and exponentially, quarter after quarter, it signals that the company has begun its controlled, repeatable, and scalable growth. Consequently, the product-market fit hypothesis will be proven correct.

How to Analyze Bookings

The correct way to observe the influence of bookings on a SaaS company is to look at the quarterly trend of Net New ARR. This metric measures the net growth of recurring revenue and comprises 3 different components:

New ARR (ARR obtained from new customers)

Expansion ARR (ARR obtained from existing customers through upselling, cross-selling, or other forms of expansion)

Contraction/Churn ARR (ARR lost due to customers who either reduced their subscription [contraction] or completely stopped using the service [churn])

Net New ARR = (New ARR + Expansion ARR) - Contraction/Churn ARR

The interesting aspect, beyond understanding how bookings influence startup growth, is seeing how each component provides valuable insights into a company's health:

New ARR values indicate product-market fit and the effectiveness of customer acquisition strategies, including sales and marketing efficiency

Expansion ARR trends demonstrate customer satisfaction and the ability to grow existing accounts

Churn/Contraction ARR percentages reveal product stickiness, customer satisfaction, and overall retention strength

Bookings shouldn't be confused with CARR (Committed Annual Recurring Revenue). While bookings represent the total contract value signed in a period (including both recurring and non-recurring revenue), CARR specifically measures the guaranteed recurring annual revenue from active contracts, typically with terms of one year or longer. CARR provides visibility into secured future revenue streams but excludes one-time fees and short-term commitments that might be included in bookings.

Mistake to Avoid

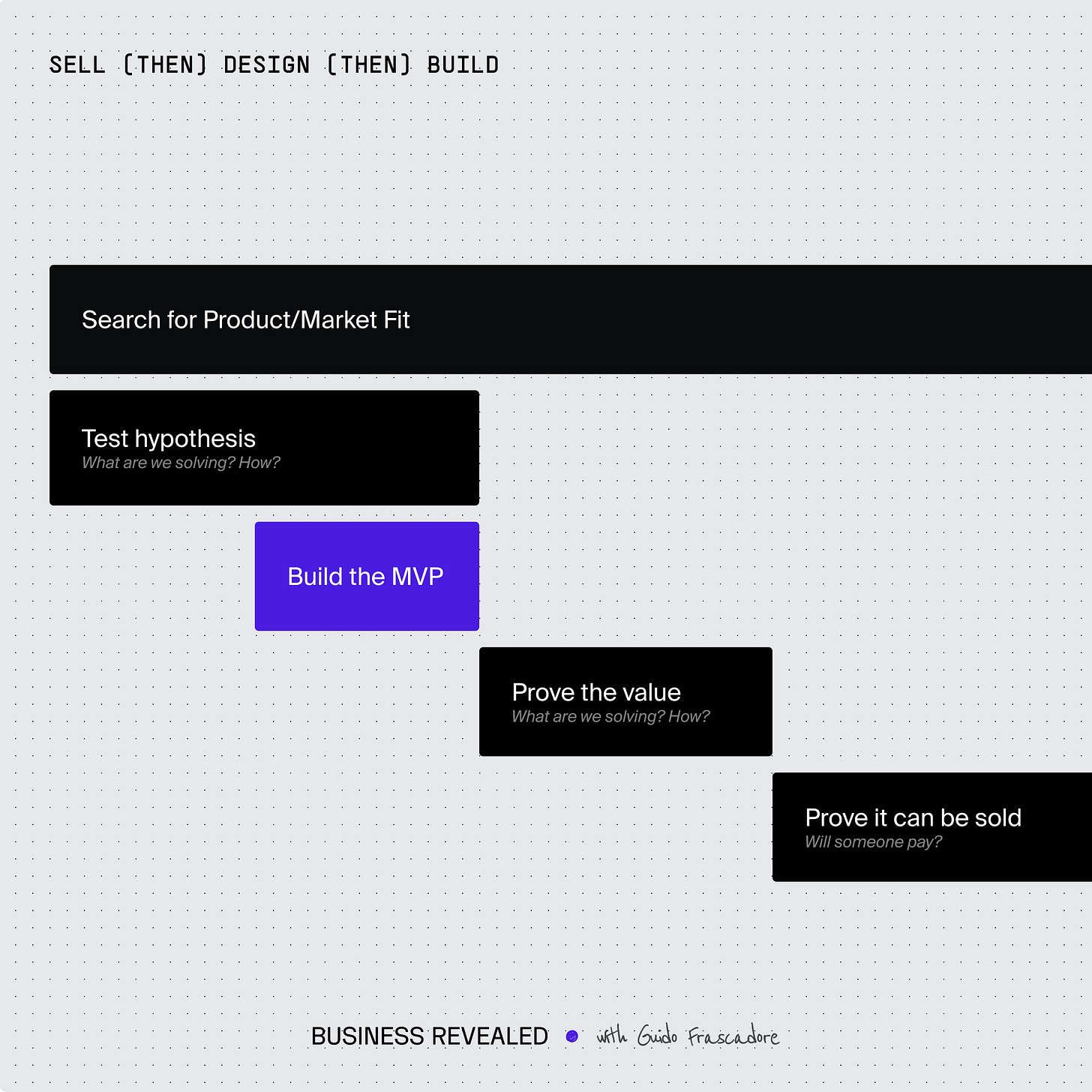

Before moving to the next step, I want to share one more point about product-market fit and its pursuit. In many cases, startups make the error of beginning their search by immediately focusing all their attention on the product and its design while neglecting the most important element of all: Would anyone actually pay for this product?

The question seems simple and might appear obvious, but in many cases it isn't. Before dedicating hours and hours of work to designing and building a product/service, the best thing to do is "try to sell it."

How? Through interviews, surveys, engaging your network - any method to get product hypotheses feedback (Here you can find a long list of tools that you can use to validate your product and hypothesis). The responses might be completely unpredictable; you might find that the problem you're trying to solve isn't that important or that there are related needs no one had thought about.

Once you've found the best product hypothesis, then you can move on to its design and development, followed by actual sales testing.

How to Make a Business Repeatable

Once you've tested and validated your product-market fit hypothesis, it's time for the company to search for a repeatable, scalable, and profitable growth model. One of the biggest mistakes companies make at this stage is rushing through steps, skipping testing and validation of key elements.

There's no law establishing a deadline by which each validation must be completed - every startup moves at its own pace. The path to growing sales is never clearly marked, and there are many unknowns to resolve:

Which stakeholders should be contacted during the sales process?

Which pain points should we leverage?

What types of messages should we use?

What pricing should we apply?

Which sales model best fits the service being sold?

Take a look at my past post on Finding the ICP, could be useful

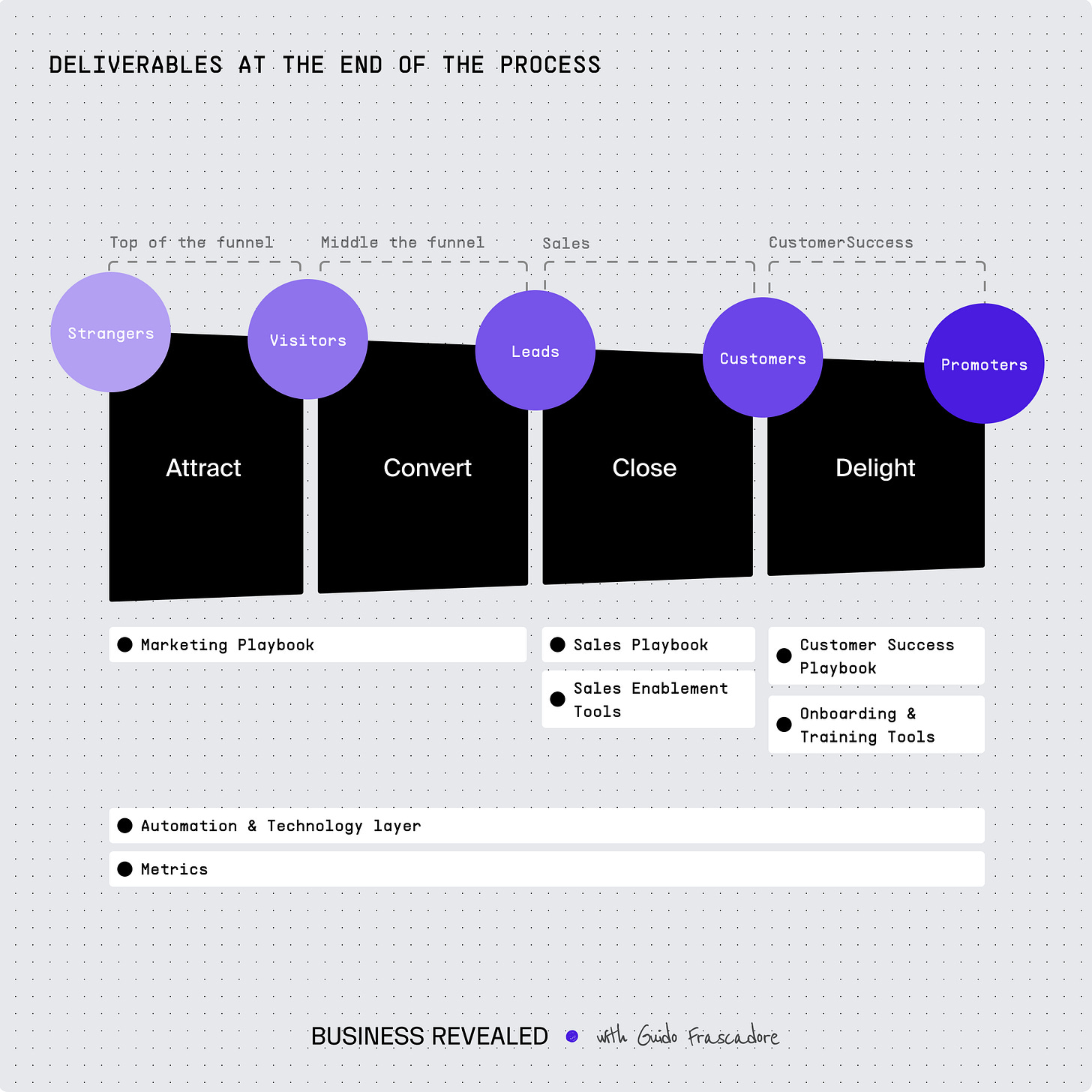

The first step in addressing these questions is making the sales process repeatable. This means consistently acquiring new customers who are satisfied with the service and can eventually become promoters.

The simplest approach is to design a funnel. This should include 4 phases:

Top of funnel (where lead collection occurs)

Middle of funnel (where conversion begins)

Sales (where the sale is closed and leads become customers)

Customer success (where the customer delight process begins with the goal of turning customers into promoters)

A common error in funnel design is entrusting its management (and thus service sales) to non-founders. Only founders can truly understand feedback from initial sales attempts and recognize necessary improvements to the product/service being sold.

Defining the Playbook

Ideally, especially when founders aren't natural salespeople, they should be paired with what entrepreneur David Skok calls a "Pathfinder Trailblazer" - a special kind of salesperson who can guide founders through this sales exploration journey. The ultimate goal is to design a proper sales playbook that will be handed over to future hired salespeople.

Developing a playbook is crucial because it allows companies to document all the answers to the above questions and verify their effectiveness during initial sales.

During the design phase, it's important to focus on one target at a time and a single use case. There will be time to adjust gradually. The ideal approach is to start with early adopters (ECP) who will gradually lead the company toward its Ideal Customer Profile.

This process will reveal elements that define what is NOT a company's priority: unsuitable targets, wrong prospects, misleading messages, and more.

But the most interesting part will be understanding which product/service benefits potential customers find truly valuable and can be leveraged in the sales process: customers care relatively little about the product itself - what they want to know is whether it will solve their problems.

This step can only be considered complete when a startup can successfully sell the promised benefits through a repeatable process. This means knowing how to:

Generate contacts following standardized processes

Identify which stakeholders to contact to initiate sales

Conduct sales effectively

Apply appropriate pricing

Most importantly, make the entire process accessible to future company salespeople

Enter the Sales Team

To validate the playbook and prove that the achieved repeatable process is correct, founders must make room for ordinary salespeople.

To do this, they must take on a different role compared to the testing phase where they were protagonists. They must focus on:

Hiring new team members

Training new recruits

Ensuring they have all the proper tools to conduct sales successfully

It's usually advisable to start with a first hiring round of 2 standard sales reps. The exit criteria in this case are:

Having at least one salesperson (preferably both) capable of following the designed playbook productively and autonomously

Acquiring customers who are satisfied with the service/product purchased

Excessive interference from founders in the sales cycle is a classic error that can occur with the arrival of standard sales reps. The goal is to understand if the process established in the playbook is truly repeatable and prove it can succeed even with ordinary salespeople. This requires patience and careful observation of all errors that surface, as these could contribute to improving the sales strategy.

Time to Scale?

Once you've confirmed that the sales process is repeatable by hiring initial sales reps, it's time to determine if the business can also be scalable. This begins another hiring phase - the recommendation is to hire new salespeople in pairs (there's always a risk that one's productivity won't meet company expectations).

Every salesperson will have a technical (and human) limit regarding the number of clients they can interact with simultaneously. For this reason, when a company bases most of its success on salespeople, their number and productivity will effectively determine the growth rate of bookings.

Therefore, the company's priority becomes focusing its efforts on hiring a large number of salespeople. The most common mistake here is trying to save money—a savings that would condemn the business to flat, non-scalable growth.

The HR department takes on a crucial role at this point. Beyond ensuring the arrival of a high number of salespeople, recruiters must focus on:

Hiring highly productive talent

Recruiting staff capable of training new salespeople

Finding new marketers who can help salespeople generate leads

Bringing in new personnel who can follow the customer through post-acquisition phases

I could stop here in a world without artificial intelligence, but we all know that's not the case. AI models are gradually disrupting traditional sales processes, automating outbound journeys. For the recruiting world, this presents a double challenge:

The need for trained personnel to integrate AI technology into the company architecture

The need for a new type of salesperson - one capable of correctly interacting with AI tools and enabling real process optimization

Profitable or Not Profitable, That is the Question

The search for a growth model that is repeatable, scalable, and profitable is nearly complete. After validating product-market fit, designing a repeatable sales model, and demonstrating that this model can create a scalable business, one final piece remains: proving that the entire funnel is profitable.

To do this, the most important units economics to consider are:

Customer acquisition cost (CAC)

Customer lifetime value (LTV)

Churn rate

The objective is simple: make the LTV value greater than the CAC.

LTV calculation depends on the average customer lifetime. Initially, this data will be challenging to obtain, while the churn rate will be more evident. The formula for calculating customer lifetime is, therefore, 1/churn rate.

Having a low churn rate thus becomes fundamental for improving profitability and, consequently, company value.

Customer Churn Rate vs Revenue Churn Rate

There are multiple types of churn rates; for this analysis, it's essential to consider two key metrics:

Customer Churn Rate (the percentage of customers who stop using a service/product in a given time period)

Revenue Churn Rate (the percentage of recurring revenue lost due to customer cancellations or subscription downgrades)

To illustrate the difference between these metrics, consider this example: A company starts the month with two customers:

Customer A: €1,000 MRR (Monthly Recurring Revenue)

Customer B: €5,000 MRR

Total MRR: €6,000

Scenario 1 - Customer A churns:

Customer Churn Rate = (1 churned customer / 2 total customers) × 100 = 50%

Revenue Churn Rate = (€1,000 lost MRR / €6,000 total MRR) × 100 = 16.7%

Scenario 2 - Customer B churns:

Customer Churn Rate = (1 churned customer / 2 total customers) × 100 = 50%

Revenue Churn Rate = (€5,000 lost MRR / €6,000 total MRR) × 100 = 83.3%

This example demonstrates why monitoring both metrics is crucial: Customer Churn Rate helps understand the rate of customer loss, while Revenue Churn Rate reveals the financial impact of those losses. A high-value customer churning can have a much more significant impact on the business than losing several lower-value customers.

For this reason, it's essential to:

Monitor both metrics separately

Analyze patterns in customer segments

Understand the specific reasons why customers, especially high-value ones, choose to leave

Develop targeted retention strategies based on customer value tiers

How to Achieve a Negative Churn Rate

A third metric to consider when discussing churn rate is negative net revenue churn rate (or negative net dollar churn).

Negative net revenue churn occurs when the expansion revenue from existing customers (through upselling, cross-selling, or price increases) exceeds the revenue lost from churned customers. In other words, the remaining customers generate more additional revenue than what was lost from churned customers.

For example, if:

Starting MRR: €12,000 (Customer A: €7,000, Customer B: €5,000)

Customer A churns: -€7,000

Customer B expands to €7,000: +€2,000

Net revenue change: -€5,000

Expansion revenue: €2,000

Revenue lost to churn: €7,000

The net revenue churn rate would be: [(Revenue lost to churn - Expansion revenue) / Starting MRR] × 100 = [(-€7,000 + €2,000) / €12,000] × 100 = -41.67%

A negative net revenue churn rate is considered a strong positive signal for companies, as it demonstrates the ability to grow revenue from the existing customer base, offsetting losses from customer churn.

To achieve negative net revenue churn, companies typically implement strategies such as:

Introducing premium tiers or add-on features

Implementation of usage-based pricing models

Strategic product expansions and upgrades

Value-based price increases aligned with customer success

While achieving negative net revenue churn might not be an immediate priority for early-stage startups focused on customer acquisition, it becomes increasingly important for sustainable growth and profitability as the company matures.

Hit the Gas and Scale

Every industry has its own reference values for unit economics, but in general, in the SaaS world, LTV is considered an excellent metric when it exceeds CAC by at least 3 times. Similarly, a period of 12 to 18 months is considered optimal for recovering CAC spending.

These values, along with gross margin, form the foundation for understanding whether the company is operating profitably and whether it's ready to invest money to establish itself as a scalable business.

If this latter scenario materializes, the critical mistake to avoid is continuing to be frugal. Such penny-pinching serves no purpose and prevents the company from making that coveted quantum leap. Investing in growth becomes the only path forward if you aim to occupy a dominant position within your target market.

This investment will trigger a cascade of mechanisms that will attract more and more people to the brand and, naturally, drive revenue growth.

True, a company might reach this stage with limited available funds and struggle to step on the accelerator. The good news is that having demonstrated how repeatable, scalable, and profitable its business is, investors will be much more inclined to offer financing and put the company in a position to scale effectively.